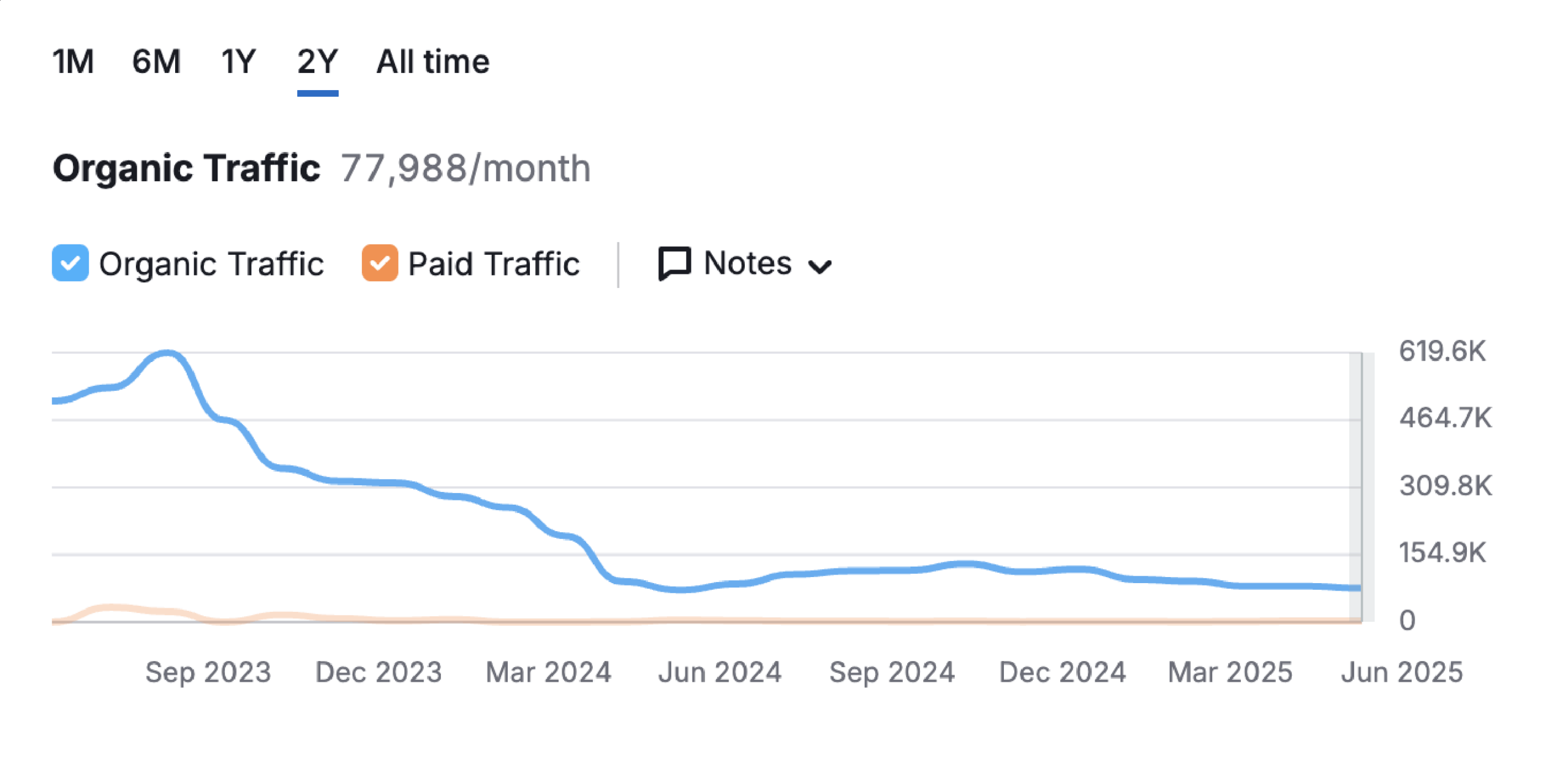

ThomasNet’s 88% Traffic Decline: Unpacking the Downfall of an Industrial Giant

According to SEMRush, ThomasNet.com’s US desktop organic traffic has seen a decline of 88% from June 2023 to June 2025, which represents a 541,000 loss in monthly traffic.

What really happened, and why? Several factors have contributed to this long-term decline in Thomas traffic:

- SEO and Google Conflict: In the competitive landscape of online search, ThomasNet’s visibility diminished in part due to Google releasing various algorithm updates. It appears that Google wants to stop rewarding websites like ThomasNet that compete for advertising dollars. What we find odd is that ThomasNet hasn’t responded with an aggressive PPC campaign as in years past.

- Digital Transformation Challenges: As the manufacturing industry embraced digitalization, ThomasNet struggled to keep pace with rapidly evolving technologies and user expectations. Competitors offering more advanced digital solutions began to capture market share, leaving ThomasNet lagging behind.

- Increased Competition: The rise of new online marketplaces and platforms such as Amazon provided manufacturers with alternative avenues for sourcing and supplier discovery. These platforms often offered more user-friendly interfaces, better search functionalities, and integrated services, making them more attractive to users.

- Shift in User Behavior: People are increasingly getting answers from artificial intelligence like ChatGPT, CoPilot, and DeepSeek. Modern buyers prefer platforms that offer comprehensive digital experiences, including real-time communication, instant quoting, and seamless transactions. ThomasNet’s traditional directory model did not fully align with these evolving preferences. 88% is a significant decline in traffic and a strong indicator that ThomasNet may be struggling to maintain relevance in the modern digital landscape.

- Acquisition by Xometry: A Strategic Move That Backfired for Thomas Advertisers In a strategic move to bolster its digital manufacturing marketplace, Xometry acquired ThomasNet in December 2021. While the cash and stock transaction, valued at $300 million was a benefit to the Thomas family, it’s been a disaster for ThomasNet’s advertisers and the salesforce that once provided outstanding services.

- On-Demand Jobs?: While Xometry owns ThomasNet, it doesn’t automatically mean that ThomasNet advertisers (custom manufacturers) get direct access to on-demand jobs from Xometry’s AI-powered marketplace. At this point, ThomasNet remains a lead generation platform only.

- Cost Cutting: To maintain its high-margin business, Xometry dramatically reduced their cost of sales by terminating a majority of their salesforce, including most of their brightest and best salespeople. It remains to be seen if they will offer a 100% self-service model like Google PPC ads. Enhancing operational efficiency and margins may have also led to cutting costs in support of boosting their ThomasNet traffic.

- Change of Focus: What is clear is that the focus is now on the parent company Xometry, not ThomasNet. Xometry has an aggressive Google PPC campaign while ThomasNet doesn’t. The company’s response (or rather, lack of it) – doing nothing to reverse the decline in traffic – will accelerate the departure of ThomasNet advertisers.

Impact on Advertisers – Navigating the Shift

Advertisers who deeply depend on ThomasNet for lead generation and visibility have been seeing diminishing returns over the last few years.

- Fewer Leads: Traffic declines on ThomasNet directly reduce advertiser ROI. Fewer ThomasNet visitors mean fewer opportunities for leads.

- Unqualified Leads: Advertisers might receive inquiries from non-decision-makers, international buyers, or buyers outside their service area, or solicitations rather than genuine leads. In-depth research into one ThomasNet advertiser’s leads (contact us and RFQ forms) showed that none of the leads were qualified.

- Lack of Transparency: ThomasNet’s own analytical reporting (WebTrax) shows declining traffic and leads for advertisers. ThomasNet will tout that profile views are up, but intelligent businesspeople only want qualified leads. Lastly, ThomasNet will not share the SEMrush report showing the massive drop in their site traffic.

Conclusion

The truth is out there for all to see – yesterday’s giants no longer enjoy a monopoly today. As a result of this worsening scenario, many ThomasNet advertisers are reconsidering their marketing investments, or have already done so. They are seeking alternative marketing tactics that offer better reach, more advanced analytics and improved ROI. Younger generations are using AI and other platforms to gather information. Even Google has seen their share of the U.S. search-advertising market fall below 50% for the first time since the company began tracking it. What this means for your business is that there are potential buyers who don’t use these platforms like they used to do to find a manufacturing supplier. As a B2B marketer, investing solely in a platform where you are losing traffic is not worth it, because no matter how high your listing on this platform is, you won’t get the leads you deserve.

It’s time to think hard. Is your marketing strategy sailing smoothly or headed for disaster? Reach out to Marketing Metrics Corp. today and secure a strategy that not only keeps your business afloat but also helps it to thrive in today’s fiercely competitive market.

Let us help you navigate the challenges and steer your business toward sustainable success. Contact us to set up a convenient time to talk.